SCOTUS has

KILLED Income Tax Enforcement

The

IRS and the DOJ are NOW DEAD & FINISHED in the Federal Courts

Because of the recent Moore decision by the Supreme Court Link

to the Moore Opinion (click here), the DOJ is now foreclosed in all of its legal

actions in the federal courts pursuing the enforcement of the federal personal income

tax as a direct non-apportioned tax. They cannot

proceed and can easily be defeated now, in ALL legal actions in the

federal courts, BOTH civil and criminal.

Please read the following

and review

the SCOTUS case Opinion.

1.

In this Moore

decision the Supreme Court

loudly declares, plainly and clearly, AGAIN, that the federal

income tax is an indirect tax under authority of Article I, Section 8, clause 1, and is not a non-apportioned direct

tax under authority of the

16th Amendment without limitation, confirming the argument position that

it is the federal courts themselves that have assumed the patently frivolous position in all tax litigation for the last

65 years, i.e.: the DOJ has

argued, and the lower federal courts have declared, that the 16th

Amendment, despite the irrefutable absence of an enabling enforcement clause in the Amendment to constitutionally authorize

the U.S. Congress to write new law, or use existing law, to enforce any power to tax income allegedly created by the adoption of the

Amendment; they argue, and have argued, that the 16th Amendment can never-the-less

be utilized by the courts to take jurisdiction over legal actions, both civil

and criminal, under authority of the 16th Amendment to enforce a non-apportioned

direct tax on income without limitation,

which is what the IRS has

been assessing in operational practice for 65 years.

But that has been, and is now fully exposed by this Moore

decisions as, a patently false and frivolous position the courts have been utilizing for 65 years to enforce only the 2nd Plank of the Communist Manifesto[1]

on We the American People under

the guise and pretense, and in place of, constitutionally authorized taxation. This is absolutely TRUE because, again, the Supreme Court has declared (again) that the federal

income tax is an indirect tax under authority of Article I, Section 8, clause 1[2],

and is not a direct tax under authority of the 16th Amendment as the IRS, the DOJ,

and the lower federal courts have been telling defendants at trial for 65 years. IT

WAS ALL A LIE. THIS IS HUGE NEWS

PEOPLE! WAKE UP!!

FOR 65 YEARS

NOT A SINGLE “income tax” COURT CASE HAS BEEN LEGITIMATE!

2.

This of course means that every district

and circuit court in the country has improperly

and unlawfully conducted entire civil and criminal trials for

over 65 years without the

subject-matter jurisdiction necessary

to do so, because the lower courts have accepted the erroneous argument

that their subject-matter jurisdiction was

based on a power to tax income directly

under alleged authority of the 16th Amendment without apportionment. However, the recently decided Moore SCOTUS

decision factually proves that

was NEVER TRUE, NOR correct! Beyond the shadow of any doubt at all now, those claims were FALSE. The alleged subject-matter jurisdiction of the courts, despite

numerous challenges, was never properly,

legally, established or shown on the record of the actions in the court, and in

many cases, there is no

properly established, fully-granted, subject-matter

jurisdiction of the court that is shown anywhere on the record

of the action in the court, that could lawfully have been taken

by the court over the criminal prosecution of the defendant, or a civil

prosecution for money, for the alleged income tax “failures” and or “crimes” alleged committed. The courts have conducted every single civil

and criminal trial without the granted jurisdiction, or subject-matter jurisdiction,

to legally do so. The verdicts must ALL be set aside, and the judgments ALL vacated as a court that lacks subject-matter jurisdiction cannot

render a valid judgment.

"It is well established that federal courts are courts of limited jurisdiction, possessing only that power authorized by the Constitution and statute." Hudson v. Coleman, 347 F.3d 138, 141 (6th Cir. 2003)

“So, we conclude, as we did in the prior case, that,

although these suits may sometimes so present questions arising under the

Constitution or laws of the United States that the Federal courts will have

jurisdiction, yet the mere fact that a suit is an adverse suit authorized by

the statutes of Congress is not in and of itself sufficient to vest

jurisdiction in the Federal courts.” Shoshone Mining Co. v. Rutter, 177 U.S. 505, 513 (1900).

"Federal courts are courts of limited jurisdiction. They

possess only power authorized by Constitution and statute, which is not to be

expanded by judicial decree. It is to be

presumed that a cause lies outside this limited jurisdiction, and the burden of

establishing the contrary rests upon the party asserting jurisdiction." Kokkenen V. Guardian Life Ins.

Co. of America, 511 US 375 (1994)

"Courts are constituted by authority and they cannot go

beyond that power delegated to them. If they act beyond that authority, and

certainly in contravention of it, their judgments and orders are regarded as

nullities ; they are not voidable, but simply void, and this even prior to

reversal." Williamson v. Berry, 8 HOW. 945,

540 12 L.Ed. 1170, 1189 (1850).

"Subject-matter

jurisdiction, because it involves a court's power to hear a case, can never be

forfeited or waived. Consequently, defects in subject-matter jurisdiction

require correction regardless of whether the error was raised in district

court. See, e. g., Louisville & Nashville R. Co. v. Mottley, 211 U. S. 149 (1908)."

United

States v. Cotton, 535 U.S.

625, 630 (2002);

“... in a long and venerable line of our cases. “Without jurisdiction the court cannot proceed at all in any cause. Jurisdiction is power to declare the law, and when it ceases to exist, the only function remaining to the court is that of announcing the fact and dismissing the cause.” Ex parte McCardle, 7 Wall. 506, 514 (1869). ... The requirement that jurisdiction be established as a threshold matter “spring[s] from the nature and limits of the judicial power of the United States” and is “inflexible and without exception.” Mansfield, C. & L. M. R. Co. v. Swan, 111 U.S. 379, 382 (1884). ... The statutory and (especially) constitutional elements of jurisdiction are an essential ingredient of separation and equilibration of powers, restraining the courts from acting at certain times, and even restraining them from acting permanently regarding certain subjects. See United States v. Richardson, 418 U.S. 166, 179 (1974); Schlesinger v. Reservists Comm. to Stop the War, 418 U.S. 208, 227 (1974). For a court to pronounce upon the meaning or the constitutionality of a state or federal law when it has no jurisdiction to do so is, by very definition, for a court to act ultra vires. Steel Co., aka Chicago Steel & Pickling Co. v. Citizens for A Better Environment, No. 96-643, 90 F.3d 1237 (1998)

A court may

not render a judgment which transcends the limits of its authority, and a

judgment is void if it is beyond the powers granted to the court by the law of

its organization, even where the court has jurisdiction over the parties and

the subject matter. Thus, if a court is authorized by statute to entertain

jurisdiction in a particular case only and undertakes to exercise the

jurisdiction conferred in a case to which the statute has no application, the

judgment rendered is void. The lack of statutory authority to make particular

order or a judgment is akin to lack of subject matter jurisdiction and is

subject to collateral attack. 46 Am. Jur. 2d, Judgments

§ 25, pp. 388-89.

"A void judgment

is one that has been procured by extrinsic or collateral fraud or entered by a

court that did not have jurisdiction over the subject matter or the

parties." Rook v. Rook, 233 Va. 92, 95, 353 S.E.2d 756,

758 (1987)

3. And now, in this Moore decision of the United States Supreme Court, that was just decided in June of this year (2024), SCOTUS plainly and clearly declares that it is fundamental constitutional law that income taxes are foundationally speaking, indirect taxes under Article I, Section 8, clause 1, and ALWAYS HAVE BEEN! And they explain that the federal personal income tax is NOT a non-apportioned direct tax under authority of the 16th Amendment that is without subjectivity to any constitutional limitation. On page 2 of the Moore Syllabus it plainly and clearly states:

(a) Article I of the Constitution

affords Congress broad power to lay and collect taxes. That power includes direct

taxes—those imposed on persons or property—and indirect taxes—those

imposed on activities or transactions. Direct taxes must be apportioned

among the States according to each State’s population, while indirect

taxes are permitted without apportionment but must “be uniform

throughout the United States,” §8, cl. 1. Taxes on income are

indirect taxes, and the Sixteenth Amendment confirms that (as

such) taxes on income need not be apportioned. Moore v. United States, No. 22–800, Argued

December 5, 2023 - Decided June 20, 2024.

4. The court provides in the Moore Opinion itself (attached as Exhibit A) on pages 5-7:

“Article I of the

Constitution affords Congress broad “Power To lay and collect Taxes, Duties,

Imposts and Excises.” Art. I, §8, cl. 1.

That power includes “‘two great classes of’” taxes—direct taxes and

indirect taxes. Brushaber v. Union Pacific R. Co., 240 U. S. 1,

13 (1916).

Generally speaking, direct

taxes are those taxes imposed on persons or property. See National

Federation of Independent Business v. Sebelius, 567 U. S. 519,

570–571 (2012). As a practical matter, however, Congress has rarely enacted

direct taxes because the Constitution requires that direct taxes be

apportioned among the States. To be

apportioned, direct taxes must be imposed “in Proportion to the Census

of Enumeration.” U.S. Const., Art. I, §9, cl. 4; see also §2, cl. 3. In other

words, direct taxes must be apportioned among the States according to

each State’s population.

So if Congress imposed

a property tax on every American homeowner, the citizens of a State with five

percent of the population would pay five percent of the total property tax,

even if the value of their combined property added up to only three percent of

the total value of homes in the United States. To pay five percent, the tax

rate on the citizens of that State would need to be substantially higher than

the tax rate in a neighboring State with the same population but more valuable

homes.

To state the obvious,

that kind of complicated and politically unpalatable result has made

direct taxes difficult to enact. Indeed, the parties have cited no apportioned

direct taxes in the current Internal Revenue Code, and it appears that Congress has not

enacted an apportioned (direct) tax since the Civil War. See 12 Stat. 297; E. Jensen, The Taxing Power: A Reference Guide to

the United States Constitution 89 (2005).

By contrast, indirect

taxes are the familiar federal taxes imposed on activities or transactions.

That category of taxes includes duties, imposts, and excise taxes,

as well as income taxes. U. S. Const., Art. I, §8, cl. 1;

Amdt. 16. Under the Constitution, indirect taxes must “be uniform

throughout the United States.” Art. I, §8, cl. 1. A “‘tax is uniform when it

operates with the same force and effect in every place where the subject of it

is found.’” United States v. Ptasynski, 462 U. S. 74, 82 (1983).

Because income taxes are

indirect taxes, they are permitted under Article I, §8 without apportionment

[because they are indirect, not direct]. As this Court has said, Article I,

§8’s grant of taxing power “is exhaustive,” meaning that it could “never”

reasonably be “questioned from the” Founding that it included the power “to lay

and collect income taxes.” Brushaber, 240 U. S., at 12–13. In 1861,

Congress enacted the Nation’s first unapportioned income tax. 12 Stat. 309. The

Civil War income tax was recognized as an indirect tax “under the

head of excises, duties and imposts.” Brushaber, 240 U. S., at 15; see

also Springer v. United States, 102 U. S. 586, 598, 602 (1881)

In 1895, however, in Pollock

v. Farmers’ Loan & Trust Co., this Court held that a tax on

income from property equated to a tax on the property itself, and thus was a

direct tax that had to be apportioned among the States. 158 U. S. 601, 627–628.

The Pollock decision sparked significant confusion and controversy

throughout the United States.

Congress and the States

responded to Pollock by approving a new constitutional amendment.

Ratified in 1913, the Sixteenth Amendment rejected Pollock’s conflation

of (i) income from property and (ii) the property itself. The Amendment provides: “The Congress shall

have power to lay and collect taxes on incomes, from whatever source derived,

without apportionment among the several States, and without regard to any

census or enumeration.” U. S. Const., Amdt. 16 (emphasis added).

Therefore, the Sixteenth

Amendment expressly confirmed what had been the understanding of the

Constitution before Pollock: Taxes on income—including taxes on income from property—are indirect taxes that need not be

apportioned. Brushaber, 240 U. S., at 15, 18. Meanwhile, property taxes remain direct taxes

that must be apportioned. See Helvering v. Independent Life Ins. Co.,

292 U. S. 371, 378–379 (1934).” Moore v. United States, No. 22-800, June

20, 2024, pg.5-7

5. This SCOTUS decision means that the district and circuit court erroneously and unlawfully conducted entire civil and criminal trials of defendants without the subject-matter jurisdiction to do so FOR THE LAST 65 YEARS OF AMERICAN HISTORY, without ever establishing on the record of ANY action in the courts, a legitimate subject-matter jurisdiction of the court that could be lawfully taken by the court over the criminal charges or civil claims brought to trial by the United States DOJ. Link to the Moore Opinion (click here)

6. The lack of subject-matter jurisdiction of the court to conduct the civil and criminal trials of defendants that is has unconstitutionally been conducting is now obvious and irrefutable, and the errors being made at trial are fatal and irreparable because the courts are erroneously and fraudulently dictating that the alleged jurisdiction of the court over the legal prosecution of the defendants is based on an alleged power to enforce the federal income tax as a non-apportioned direct tax under alleged authority of the 16th Amendment without any constitutional limitation being applicable to the new power to tax under that Amendment, which, by this Moore decision, was YEARS of fatal error by the courts in their jurisdictional declarations asserting the alleged subject-matter jurisdiction taken over the civil and criminal trials of all defendants. There is absolutely no constitutional subject-matter jurisdiction granted to enforce the federal personal income tax as a non-apportioned direct tax under alleged authority of the 16th Amendment, rather than as a uniform indirect tax under authority of Article I, Section 8, clauses 1 and 18. Under this new Moore decision from SCOTUS, the alleged subject-matter jurisdiction erroneously asserted by the federal courts, does not constitutionally exist, and never has (existed).

THAT IS FATAL, IRREPERABLE,

ERROR committed by the IRS, the DOJ, and the federal courts, literally OVER 100

MILLION times. The FRAUD & CRIME

MUST END NOW! WAKE UP! WAKE

UP! America WAKE UP. You have been

VICTIMIZED, ROBBED, and ENSLAVED by YOUR OWN SO-CALLED “COURTS of LAW”.

More like “COURTS of

COMMUNISM & COMPLIANCE”).

7. The courts’ claims to subject-matter jurisdiction over criminal and civil trials, based on an alleged power to enforce a non-apportioned direct tax on income under alleged authority of the 16th Amendment, was a clear and fatal error. The courts ALWAYS lacked the subject-matter jurisdiction to conduct the criminal and civil trials of the defendants under alleged authority of the 16th Amendment, which trials the courts wrongfully allowed to occur and be conducted without a legitimate constitutional basis for the subject-matter jurisdiction alleged taken by the court under that 16th Amendment. The Supreme Court repeatedly asserts in this Moore decision that the federal income tax is an indirect tax under the constitutional authority of Article I, Section 8, clause 1, and is not a direct tax under the 16th Amendment as was erroneously assumed, and held, by the federal courts for the last 65 years to wrongfully and prejudicially claim that a granted subject-matter jurisdiction of the court that could be taken under the 16th Amendment, existed, when it did NOT.

8. The Moore SCOTUS decision exposes as erroneous the claims made in every trial, by both the DOJ and the IRS witnesses, that the income tax is a direct non-apportioned tax. It is not. It is an indirect tax, and always has been because the Moore Opinion cites the Brushaber decision in 1916 as the controlling case deciding that the federal income tax is an indirect tax under authority of Article I, Section 8, clauses 1 and 18, and is not a direct non-apportioned tax under authority of the 16th Amendment. The new SCOTUS Moore decision exposes the fact that it is the IRS’ Frivolous Positions document, and the DOJ’s arguments in this case, that actually assert a patently frivolous position regarding the constitutional nature of the federal personal income tax, i.e.: that the 16th Amendment, despite not containing the word “direct ” and not having an enabling enforcement clause, is nevertheless the source of authority in the courts for the enforcement of a direct tax on income without constitutional limitation. That is a patently fraudulent argument, and always has been, and the time has come for the federal courts to shut-down the fraudulent enforcement of the federal income tax that is occurring by both the IRS, the DOJ, and the lower district and circuit courts of appeals themselves, as a non-apportioned direct tax without subjectivity to any constitutional limitation. Under Moore, SCOTUS plainly and clearly says that is NOT authorized by the 16th Amendment because the tax is an indirect tax under Article I, Section 8, - and is NOT a direct tax at all.

9. The federal income tax is an indirect tax and is not a non-apportioned direct tax as erroneously asserted in those IRS Frivolous Position documents, and by the plaintiff in every case in the last 65 years. Here is the IRS/DOJ frivolous position argument #6, verbatim, from that Frivolous Position document, which (position) is now irrefutably exposed by the Moore decision, as complete legal nonsense that the federal court are now compelled by the SCOTUS decision to reject and correct in ALL FUTURE LEGAL PROCEEDINGS, where this information is brought to the attention of the court, regardless of a jury’s verdict or a court’s granting of (summary) judgment.

“6. Contention: The Sixteenth Amendment does not

authorize a

direct non-apportioned federal income tax on United States

citizens.

Some assert that the Sixteenth Amendment does not authorize a direct

non-apportioned income tax and thus, U.S. citizens and residents are not

subject to federal income tax laws. …

The Law: The constitutionality of the Sixteenth Amendment has

invariably been upheld when challenged. And numerous courts have both

implicitly and explicitly recognized that the Sixteenth Amendment

authorizes a non-apportioned direct income tax on United States citizens

Link to the Frivolous Document text (click here)

10. That statement, that the Sixteenth Amendment authorizes a non-apportioned direct income tax on United States citizens, is a BLATANT LIE. The Supreme Court NEVER HELD THAT. That erroneous belief comes out of a series of lower court decisions that tried to, and effectively were allowed to, REVERSE the TRUE holding of the Supreme Court in its Brushaber v. Union Pacific RR Co., 240 US 1 (1916) decision. The Moore SCOTUS decision exposes this “direct tax” jurisdictional argument as a completely fraudulent argument and restores the true holding of Brushaber that the federal personal income tax is an indirect tax. IT is their claim that is the actual frivolous argument. The district courts have based entire civil and criminal trials of defendants on a fraudulent basis and erroneous argument and non-existent claim of jurisdiction when none ever existed. Moore also exposes the wrongful operational practice of the IRS in its defacto administrative process of assessing the tax as a non-apportioned direct tax without limitation, instead of as an indirect tax that must be uniform; - and without regard to any defendant’s complete lack of any legal, constitutional subjectivity to any Impost, Duty, or Excise tax (and or taxation) in law, that applies to the activities those defendants had engaged in.

11. The federal courts have unlawfully conducted entire civil and criminal trials of defendants for 65 years under an erroneous claim to the alleged subject-matter jurisdiction of the court that could be lawfully taken over the specific claims for tax alleged owed, or of crimes alleged committed, and now that the Supreme Court has exposed the fatal error in the claimed subject-matter jurisdiction of those federal courts; the courts now have no option left to them, within their legal discretion, except to vacate the judgments and set aside the verdict when petitioned, because they were ALL rendered by a court that fatally lacked the subject-matter jurisdiction under the 16th Amendment to take jurisdiction to enforce the direct tax on “income” that was operationally assessed by the IRS operating under the same erroneous belief that the income tax was a direct non-apportioned tax without the apportionment that is still required of all direct taxes according to the Supreme Court in this controlling Moore decision. This was fatal error committed by the plaintiff’s IRS in alleging invalid assessments of a direct tax laid upon an individual citizen, rather than being properly laid (as a direct tax) with the required apportionment of the tax to the fifty states.

12. This Moore decision of course, simply reasserts the consistent rulings of the high court across 100 years of litigation, which the lower courts unlawfully reversed, and which plaintiff’s Department of Justice has repeatedly and consistently labeled since 1960, as frivolous as it has consistently argued for the last 65 years for the reversal of the Supreme Court’s true holdings in Brushaber on the constitutional nature of the federal income tax, which I now faithfully recite again, just as I have correctly done over the last 40 years. While the DOJ has argued nothing but frivolous nonsense and fatal error, or has refused to make any argument at all sufficient to legally establish the lawful subject-matter jurisdiction of the court that had been supposedly taken over this criminal or civil prosecution, and trial, of any defendant, and thereby lawfully allowed the court to proceed to enforce, allegedly under authority of the 16th Amendment, a non-existent, direct and non-apportioned tax on income without subjectivity to any constitutional limitation, as erroneously argued by the plaintiff in all trial proceedings (when challenged to explain the jurisdiction of the court).

“… by the previous ruling [Brushaber v Union Pacific R. Co.] it was settled that the provisions of the Sixteenth Amendment conferred no new power of taxation but simply prohibited the previous complete and plenary power of income taxation possessed by Congress from the beginning from being taken out of the category of indirect taxation to which it inherently belonged ….” Stanton v. Baltic Mining Co., 240 U.S. 103, 112-113 (1916)

"Whether the tax is to be classified as an "excise" is in truth not of critical

importance. If not that, it is an "impost" (Pollock v. Farmers' Loan

& Trust Co., 158 U.

S. 601, 158 U. S. 622, 158 U. S. 625;

Pacific

Insurance Co. v. Soble, 7 Wall. 433, 74 U. S. 445),

or a "duty" (Veazie Bank v. Fenno, 8 Wall. 533, 75 U. S. 546,

75 U. S. 547;

Pollock v. Farmers' Loan & Trust Co., 157 U. S. 429,

157 U. S. 570;

Knowlton v. Moore, 178 U. S. 41,

178 U. S. 46). A capitation or other "direct" tax it certainly is not." Steward Mach. Co. v.

Collector, 301 U.S. 548

(1937), at 581-2

"The subject matter of taxation

open to the power of the Congress is as comprehensive as that open to the power

of the states, though the method of apportionment may at times be different.

"The Congress shall have power to lay and collect taxes, duties, imposts

and excises." Art. 1, § 8. If

the tax is a direct one, it shall be apportioned according to the census or

enumeration. If it is a duty, impost,

or excise, it shall be uniform throughout the United States. Together,

these classes include every form of tax appropriate to sovereignty. Cf. Burnet v. Brooks, 288 U. S. 378, 288 U. S.

403, 288 U. S. 405; Brushaber v.

Union Pacific R. Co., 240 U. S. 1, 240 U. S.

12." Steward Mach. Co. v. Collector, 301 U.S. 548 (1937), at 581

"The [income] tax being an excise, its imposition must conform

to the canon of uniformity. There has been no departure from this

requirement. According to the settled doctrine the uniformity exacted is

geographical, not intrinsic. Knowlton v. Moore, supra, p. 178 U. S. 83;

Flint v. Stone Tracy Co., supra, p. 220 U. S. 158;

Billings v. United States, 232 U. S. 261,

232 U. S. 282;

Stellwagen v. Clum, 245 U. S. 605,

245 U. S. 613;

LaBelle Iron Works v. United States, 256 U. S. 377,

256 U. S. 392;

Poe v. Seaborn, 282 U. S. 101,

282 U. S. 117;

Wright v. Vinton Branch Mountain Trust

Bank, 300 U. S. 440." Steward Mach. Co. v. Collector, 301 U.S. 548 (1937), at 583

"Duties and imposts are terms commonly applied to levies made by

governments on the importation or exportation of

commodities. Excises are "taxes laid upon the manufacture, sale or

consumption of commodities within the country, upon licenses to pursue certain

occupations, and upon corporate privileges

... the requirement to pay

such taxes involves the exercise of the privilege and if business is

not done in the manner described no tax is payable...it is the privilege which

is the subject of the tax and not the mere buying, selling or handling of

goods." Cooley, Const. Lim., 7th ed., 680." Flint v. Stone Tracy Co., 220 U.S. 107,

151, 31 S.Ct. 342, 349 (1911)

"The Sixteenth Amendment, although referred to in

argument, has no real bearing, and may be put out of view. As pointed out in

recent decisions, it does not extend the taxing power to new or

excepted subjects, but merely removes all occasion which otherwise might

exist for an apportionment among the states of taxes laid on income, whether it be derived from one

source or another. Brushaber v. Union Pacific R. Co., 240 U. S. 1,

240 U. S.

17-19; Stanton v. Baltic Mining Co., 240 U. S. 103,

240 U.

S. 112-113." Peck & Co v. Lowe, 247 U.S. 165 (1918), at 172-3

(emphasis added)

"Moreover in addition the conclusion reached in the Pollock case did not in any degree involve holding that income taxes generically and necessarily came within the class of direct taxes on property, but on the contrary recognized the fact that taxation on income was in its nature an excise entitled to be enforced as such unless and until it was concluded that to enforce it would amount to accomplishing the result which the requirement as to apportionment of direct taxation was adopted to prevent, in which case the duty would arise to disregard form and consider substance alone and hence subject the tax to the regulation as to apportionment which otherwise as an excise would not apply to it." Brushaber, supra, at 16-17.

"The various propositions are so intermingled as to cause it to be difficult to classify them. We are of opinion, however, that the confusion is not inherent, but rather arises from the conclusion that the Sixteenth Amendment provides for a hitherto unknown power of taxation, that is, a power to levy an income tax which although direct should not be subject to the regulation of apportionment applicable to all other direct taxes. And the far-reaching effect of this erroneous assumption will be made clear by generalizing the many contentions advanced in argument to support it," Brushaber, supra, at 10-11

"But it clearly results that the proposition and the contentions under it, if acceded to, would cause one provision of the Constitution to destroy another; that is, they would result in bringing the provisions of the Amendment exempting a direct tax from apportionment into irreconcilable conflict with the general requirement that all direct taxes be apportioned. Moreover, the tax authorized by the Amendment, being direct, would not come under the rule of uniformity applicable under the Constitution to other than direct taxes, and thus it would come to pass that the result of the Amendment would be to authorize a particular direct tax not subject either to apportionment or to the rule of geographical uniformity, thus giving power to impose a different tax in one state or states than was levied in another state or states. This result, instead of simplifying the situation and making clear the limitations on the taxing power, which obviously the Amendment must have been intended to accomplish, would create radical and destructive changes in our constitutional system and multiply confusion." Brushaber, supra at 12

"Duties and imposts

are terms commonly applied to levies made by governments on the importation or

exportation of commodities . Excises are "taxes laid upon the

manufacture, sale or consumption of commodities within the country, upon

licenses to pursue certain occupations, and upon corporate privileges ... the requirement

to pay such taxes involves the exercise of the privilege and if

business is not done in the manner described no tax is payable...it is the

privilege which is the subject of the tax and not the mere buying, selling or

handling of goods." Cooley, Const.

Lim., 7th ed., 680." Flint v. Stone Tracy Co., 220 U.S. 107, 151,

31 S.Ct. 342, 349 (1911)[3]

The tax under consideration, as we have construed the

statute, may be described as an excise

upon the particular privilege of doing business in a corporate capacity, i.e.,

with the advantages which arise from corporate or quasi corporate organization;

or, when applied to insurance companies, for doing the business of such

companies. As was said in the Thomas Case, 192 U. S. supra, the requirement to pay such taxes involves

the exercise of privileges, and the

element of absolute and unavoidable demand is lacking. If business is not done

in the manner described in the statute, no tax is payable.

If we are correct in holding that this is an excise tax, there is

nothing in the Constitution requiring such taxes to be apportioned according to

population. Pacific Ins. Co. v. Soule, 7 Wall. 433, 19 L. ed. 95; Springer

v. United States, 102 U.S. 586, 26 L. ed. 253; Spreckels Sugar Ref. Co.

v. McClain, 192 U.S. 397, 48 L. ed. 496, 24 Sup. Ct. Rep. 376.“ Flint v. Stone Tracy Co., 220 US 107,

151-152 (1911)" Thomas v. United States,

192

U.S. 363 , 48 L. ed. 481, 24 Sup. Ct. Rep. 305

“Evidently Congress adopted

the income as the measure of the tax to be imposed with respect to the doing of business in

corporate form because it desired that the excise should

be imposed, approximately at least, with regard to the amount of benefit

presumably derived by such corporations from the current operations of the

government. In Flint v. Stone Tracy Co.

220 U.S. 107, 165 , 55 S. L. ed. 107, 419, 31 Sup. Ct. Rep. 342, Ann.

Cas. 1912 B. 1312, it was held that Congress, in exercising the right to tax a legitimate subject of taxation as

a franchise or

privilege, was not debarred by

the Constitution from measuring the taxation by the total

income, although derived in part from property which, considered by itself, was

not taxable. It was reasonable that Congress should fix upon gross income,

without distinction as to source, as a convenient and sufficiently accurate

index of the importance of the business transacted.” Stratton's Independence, Ltd. V. Howbert, 231 U.S. 399, at 416 –

417 (1913)

"As repeatedly held, this did not extend the taxing power to new

subjects, but merely removed the necessity which otherwise might exist for

an apportionment among the states of taxes laid on income. Brushaber v.

Union Pacific R. R. Co., 240 U.S. 1 , 17-19, 36 Sup. Ct. 236, Ann.

Cas. 1917B, 713, L. R. A. 1917D, 414; Stanton v. Baltic Mining Co., 240

U.S. 103 , 112 et seq., 36 Sup. Ct. 278; Peck & Co. v. Lowe, 247

U.S. 165, 172, 173 S., 38 Sup. Ct. 432.” Eisner vs. Macomber,

252 U.S. 189 (1920), at pg. 205

13)

And with respect to the legal requirement, and

judicial duty of the courts, to properly establish on the record of every

legal

action in the courts, before proceeding in adjudicating the action, the fully

granted subject-matter

jurisdiction of the court that can lawfully be taken by it over the civil or criminal prosecution of the defendant in the

court, before proceeding at trial. To wit, the courts have plainly and clearly said:

“It remains rudimentary law that "[a]s

regards all courts of the United States inferior to this tribunal, two things are

necessary to create jurisdiction, whether original or appellate. The Constitution must have given to the court the capacity to take it, and an act of Congress must have supplied it .... To the extent that such action is not taken, the power lies

dormant." The Mayor v. Cooper, 6 Wall. 247, 252, 18 L.Ed. 851 (1868); accord, Christianson v. Colt Industries Operating Co., 486 U.S. 800, 818, 108 S.Ct. 2166, 2179, 100 L.Ed.2d 811 (1988); Firestone Tire & Rubber Co. v.

Risjord, 449 U.S. 368, 379-380,

101 S.Ct. 669, 676-677, 66 L.Ed.2d

571 (1981); Kline v. Burke Construction Co., 260 U.S. 226, 233-234, 43 S.Ct. 79, 82-83,

67 L.Ed. 226 (1922); Case of the Sewing Machine Companies, 18

Wall. 553, 577-578, 586-587, 21 L.Ed. 914 (1874); Sheldon v. Sill, 8 How. 441, 449, 12 L.Ed. 1147 (1850); Cary v.

Curtis, 3 How. 236, 245, 11 L.Ed. 576 (1845); Mclntire

v. Wood, 7 Cranch 504, 506, 3

L.Ed. 420 (1813). Finley v.

United States, 490 U.S. 545 (1989). The

Supreme Court has repeatedly told the federal judiciary it may not rely

on a conclusive presumption to find against a defendant on an essential

element of a cause of action. See Sandstrom v. Montana, 442

U.S. 510, 521-523, 99 S.Ct. 2450,

2458-2459 (1979); Stanley v. Illinois, 405 U.S. 645, 654-657, 92 S.Ct.

1208, 1214-1216 (1972); Heiner v.

Donnan, 285 U.S. 312, 325-29, 52 S.Ct. 358, 360-362 (1932); Schlesinger

v. State of Wisconsin, 270 U.S. 230, 46 S.Ct. 260 (1926); Tot v. United

States, 319 U.S. 463, 468-69, 63 S.Ct. 1241, 1245-1246 (1943); Vlandis

v. Kline, 412 U.S. 441, 446, 93 S.Ct. 2230, 2233 (1973); Grupo Mexicano

de Desarrollo S.A. v. Alliance Bond Fund, Inc., 527 U.S. 308, 318-19, 119

S.Ct. 1961, 1977 (1999), and Jones v. Bolles, 76 U.S. 364, 368 (1869).

“... in a long and venerable line of our cases. “Without jurisdiction the court cannot proceed at all in any cause. Jurisdiction is power to declare the law, and when it ceases to exist, the only function remaining to the court is that of announcing the fact and dismissing the cause.” Ex parte McCardle, 7 Wall. 506, 514 (1869). ... The requirement that jurisdiction be established as a threshold matter “spring[s] from the nature and limits of the judicial power of the United States” and is “inflexible and without exception.” Mansfield, C. & L. M. R. Co. v. Swan, 111 U.S. 379, 382 (1884). ... The statutory and (especially) constitutional elements of jurisdiction are an essential ingredient of separation and equilibration of powers, restraining the courts from acting at certain times, and even restraining them from acting permanently regarding certain subjects. See United States v. Richardson, 418 U.S. 166, 179 (1974); Schlesinger v. Reservists Comm. to Stop the War, 418 U.S. 208, 227 (1974). For a court to pronounce upon the meaning or the constitutionality of a state or federal law when it has no jurisdiction to do so is, by very definition, for a court to act ultra vires. Steel Co., aka Chicago Steel & Pickling Co. v. Citizens for a Better Environment, No. 96-643, 90 F.3d 1237 (1998)

"There is no discretion to ignore lack of jurisdiction."

Joyce v. U.S., 474 F.2d 215 (1973).

“So, we conclude, as we

did in the prior case, that, although these suits may sometimes so present

questions arising under the Constitution or laws of the United States that the

Federal courts will have jurisdiction, yet the mere fact that a suit is an adverse

suit authorized by the statutes of Congress is not in and of itself

sufficient to vest jurisdiction in the Federal courts.” Shoshone Mining Co. v. Rutter, 177 U.S. 505, 513 (1900)

The Supreme Court has repeatedly told the federal judiciary it may not rely on a conclusive presumption to find against a defendant on an essential element of a cause of action. See Sandstrom v. Montana, 442 U.S. 510, 521-523, 99 S.Ct. 2450, 2458-2459 (1979); Stanley v. Illinois, 405 U.S. 645, 654-657, 92 S.Ct. 1208, 1214-1216 (1972); Heiner v. Donnan, 285 U.S. 312, 325-29, 52 S.Ct. 358, 360-362 (1932); Schlesinger v. State of Wisconsin, 270 U.S. 230, 46 S.Ct. 260 (1926); Tot v. United States, 319 U.S. 463, 468-69, 63 S.Ct. 1241, 1245-1246 (1943); Vlandis v. Kline, 412 U.S. 441, 446, 93 S.Ct. 2230, 2233 (1973); Grupo Mexicano de Desarrollo S.A. v. Alliance Bond Fund, Inc., 527 U.S. 308, 318-19, 119 S.Ct. 1961, 1977 (1999), and Jones v. Bolles, 76 U.S. 364, 368 (1869).

"Federal courts are courts of limited jurisdiction.

They possess only power authorized by Constitution and statute, which is not

to be expanded by judicial decree.

It is to be presumed that a cause lies outside this limited

jurisdiction, and the burden of establishing the contrary rests upon the party

asserting jurisdiction." Kokkenen v. Guardian Life Ins. Co. of America, 511 US 375 (1994)

"But it clearly results that the proposition and the contentions under it, if acceded to, would cause one provision of the Constitution to destroy another; that is, they would result in bringing the provisions of the Amendment exempting a direct tax from apportionment into irreconcilable conflict with the general requirement that all direct taxes be apportioned. Moreover, the tax authorized by the Amendment, being direct, would not come under the rule of uniformity applicable under the Constitution to other than direct taxes, and thus it would come to pass that the result of the Amendment would be to authorize a particular direct tax not subject either to apportionment or to the rule of geographical uniformity, thus giving power to impose a different tax in one state or states than was levied in another state or states. This result, instead of simplifying the situation and making clear the limitations on the taxing power, which obviously the Amendment must have been intended to accomplish, would create radical and destructive changes in our constitutional system and multiply confusion." Brushaber v. Union Pacific RR Co, 240 U.S. 1, pg. 12 (1916)

“By the previous ruling [Brushaber v Union Pacific R. Co.] it was settled that the provisions of the Sixteenth Amendment conferred no new power of taxation but simply prohibited the previous complete and plenary power of income taxation possessed by Congress from the beginning from being taken out of the category of indirect taxation to which it inherently belonged ….” Stanton v. Baltic Mining Co., 240 U.S. 103, 112-113 (1916)

"A void judgment is one that has been procured by extrinsic or collateral fraud or entered by a court that did not have jurisdiction over the subject matter or the parties." Rook v. Rook, 233 Va. 92, 95, 353 S.E.2d 756, 758 (1987)

14)

Therefore,

under the controlling Moore, Brushaber, and Baltic Mining decisions, every federal court in the country now has a legal, jurisprudence, duty, when Petitioned, to set

aside the old jury verdicts and vacate

the old court judgements for the proven fatal lack of

any subject-matter jurisdiction of the court that existed and was

clearly shown on the record of the action in the court at the time, or that

could have been lawfully taken by the court under alleged

authority of the 16th Amendment as erroneously

argued, sufficient to allow any court to have

conducted a criminal or civil trial of any defendant over the last 65 years for

an alleged failure to pay a direct non-apportioned tax on income without subjectivity

to any constitutionally imposed limitation,

as erroneously argued by the plaintiff’s DOJ and wrongfully assessed

in operational practice by the plaintiff United States’ IRS. Every

district court in the country is wrongfully and erroneously

doing so today at trial, as well; - by enforcing the federal personal income

tax as a

non-apportioned direct tax under alleged authority of

the 16th Amendment, relieved of all subjectivity

to any constitutional limitation imposed on the federal taxing

powers, instead of as an indirect tax under authority of Article

I, Section 8 as a function of indirect taxation by Impost,

Duty and or Excise.

It was all fatally erroneous argument and

holdings made by the plaintiff United States fraudulently and

the courts seditiously, which is ALL NOW

EXPOSED AS SUCH frivolity and sedition,

irrefutably, as a factual result of the Moore decision

taken in June 2024.

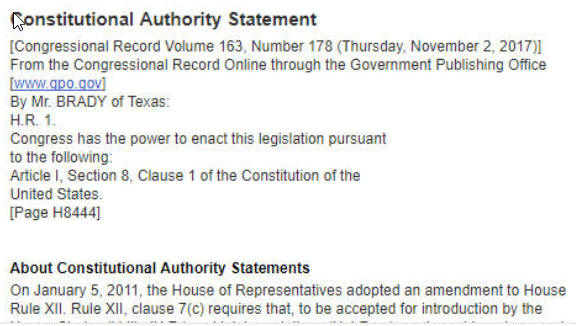

15)

When combined with the evidence of the

Constitutional Authority Statement for the new tax law that was enacted

by Congress and signed into law by President Trump in December of 2017,

effective as of January, 2018, it is impossible for an honest man (or

judge) to continue to conclude that the federal income tax is a non-apportioned direct tax under the 16th Amendment,

as that Constitutional Authority Statement for the new tax law plainly

and clearly declares the constitutional authority for the federal income tax

laws to be under the sole authority of Article I, Section 8, clauses 1

and 18 - as a constitutionally enforceable indirect tax, - and not as an unenforceable, non-apportioned, direct tax under alleged

authority of the 16th Amendment, - as was erroneously argued (when

challenged), and held (when necessary) in order for the court to be able to

appear to be able to sustain the legal proceedings in the court, in any civil or criminal case before it. Here

is the Constitutional Authority Statement for the current income tax law IRC

Section 1 – Tax imposed.

16)

Consequently, every district court in the

country now lacks the subject-matter jurisdiction

required to conduct a civil or criminal trial of any defendant under authority

of the 16th Amendment, rather than under the authority of Article I,

Section 8, clauses 1 and 18. Past verdicts

must be vacated and judgments set aside because the district and

circuit courts erroneously conducted

entire trials and rendered judgments without a proper and correct declaration,

and establishment on the record of the action in the court, of the required,

specific, subject-matter jurisdiction of

the court that was lawfully taken, sufficient

to allow the court to conduct that civil or criminal trial of that defendant.

17)

And,

because the United States’ IRS operationally erroneously assessed the income tax administratively

as though it were a non-apportioned direct tax under the 16th Amendment, and not

as a function of any indirect taxation by Impost, Duty, or Excise, the fatal defect in the jurisdiction cannot be cured

or perfected

because the underlying

nature of the IRS claims for tax, or criminal charges, cannot now be altered

from that erroneous assessment of a direct tax, instead of an enforceable

indirect one (assessment). The claim made in all of those cases, - that

a direct and non-apportioned income tax was owed by all defendants as

result of the 16th Amendment, is fundamentally without

constitutional foundation to support the direct manner in which the tax was operationally

assessed by the IRS without use of the underlying foundation of any written Impost,

Duty or Excise

tax law that is, or was,

applicable to a defendant’s actual behavior and or activities,

means that all of the civil

and criminal charges pressed today and in the future, because of that

mal-administered defective and erroneous operational practice of making assessments for the payment of

a non-apportioned direct tax that is not constitutionally authorized, must be terminated and

dismissed with prejudice, and verdicts, including jury verdicts, must be set

aside and any judgments

rendered must be vacated for lack of subject-matter jurisdiction of the court rendering the judgment or verdict.

18)

It is now absolutely clear that the jury

instruction provided by the courts to the juries at ALL income tax

trials, telling the jury that the federal income tax is to be enforced by them through

their verdict as jurors, was a non-apportioned

direct tax on all income under

authority of the 16th

Amendment, was patently wrong. Those instructions exceeded the

constitutionally granted authority to tax income

only indirectly under

authority of Article I, Section 8, clause 1, - by Duty, Impost and Excise, as

declared in the Congressional Record by Congress in writing the new

income tax law, and now, it has been finalized by the Supreme Court with

the last word on the matter, as plainly written in this new Moore decision Opinion.

It was a fatally erroneous instructions that were given to every single jury

for the last 65 years, and that fact alone is sufficient to

warrant the courts’ setting aside the verdicts and vacating the

judgments, and ordering the dismissal of entire actions today, with prejudice, as both the plaintiff and the

court are fatally refusing to

address this constitutional legal fact of law about the indirect nature of the federal

personal income tax under Article I, Section 8 of the U.S. Constitution, and not

the 16th Amendment. Again,

the erroneous claims to a

jurisdiction that did not exist, and the erroneous jury instructions given to the juries about the erroneously alleged constitutional nature of the tax, is

sufficient cause alone for the courts to set aside the verdicts, vacate the judgment, and dismiss in their entirety ALL current legal actions with prejudice for the fraud that has been perpetrated on

the good American People by the IRS, the DOJ, and the lower federal courts,

both district and the U.S. Circuit Courts of Appeals – all circuits.

"...We admit, as all

must admit, that the powers of the government are limited, and that its

limits are not to be transcended.

But we think the sound construction of the constitution must allow to

the national legislature that discretion, with respect to the means by which

the powers it confers are to be carried into execution, which will enable that

body to perform the high duties assigned to it, in the manner most beneficial

to the people. Let the end be

legitimate, let it be within the scope of the constitution, and

all means which are appropriate, which are plainly adapted to that end, which

are not prohibited, but consistent with the letter and

spirit of the constitution, are constitutional ..." McCulloch

v. State of Maryland,

17 U.S. 316 (1819) ([i])

19)

The

Supreme Court’s decision in Moore exposes the fact that:

a.

the

United States’ (IRS’s) assessment of the tax as a non-apportioned direct

tax under alleged

authority of the 16th Amendment to tax directly and without applicable limitation, was, and is, unconstitutional;

b.

the

United States’ (DOJ’s) enforcement of the tax in the any criminal trial, as a direct

tax under alleged

authority of the 16th Amendment, was, and is, unconstitutional;

c.

the United States’ (DOJ’s) enforcement of the

tax in the any criminal trial, as a direct tax without any applicable

limitation, was, and is, unconstitutional;

d.

the

United States’ (DOJ’s) enforcement of the tax in any civil

trial of any defendant, as

a direct tax without

any applicable limitation, was, and is, unconstitutional;

e.

a district court’s criminal conviction of a

defendant for allegedly not complying with direct income tax laws that do not exist

under Article I, Section 8, in order to allegedly permit the direct taxation of the defendant’s “income”

under alleged authority of the 16th Amendment without applicable

limitation, was, and

is, unconstitutional;

20)

Finally,

the exposed lack of any constitutionally granted subject-matter

jurisdiction that can

lawfully be taken under the alleged source of constitutional authority of the 16th

Amendment, means that in addition to vacating the jurisdiction-less judgments and setting

aside all of the

verdicts, the courts must also immediately release any defendants being held in

jail, as there is no legal basis or jurisdiction remaining for the court to

invoke to support the sentencing or further holding of a defendant that was wrongfully

convicted by a court

that lacked the subject-matter jurisdiction to conduct the civil or criminal trial in

the first place.

21)

Defendants

cannot be held, or sentenced by a court, on charges of failing to pay a non-apportioned

direct tax income, or

for allegedly violating laws that allegedly enforce the payment of thar

non-apportioned direct tax on income under alleged authority of the 16th Amendment, because the Supreme Court says

that “Because income taxes are indirect taxes, they are permitted under Article I, §8 without

apportionment”. This forecloses the

IRS’, DOJs’, and the federal courts’ assumed position (of a non-apportioned direct tax) and completely shuts out the

plaintiff United States from making any further spurious, frivolous “direct tax under the 16th

Amendment” arguments, or filing any further legal actions, neither civil

nor criminal, to pursue the enforcement of a claim for income tax that wrongfully

and erroneously

operationally assessed by the IRS (and or U.S. Tax Court) as a

non-apportioned direct tax, which is the proclaimed basis for every assessment done today (and

in the past) by the IRS. Its ALL

unenforceable FRAUD and this Moore SCOTUS decision irrefutably, inarguably,

absolutely, PROVES it beyond the shadow of any doubt what-so-ever.

22)

The

district and circuit court have been, and are, conducting entire civil and criminal

trials of defendants without the required subject-matter jurisdiction necessary to do so. That was, and still is fatal,

irreparable, ERROR. The historical verdicts must be vacated,

the judgments must be

set aside, and defendants must be released immediately from

confinement in jail, as a court without jurisdiction cannot hold a man in jail for trial, or

for sentencing, for allegedly breaking a law that doesn’t exist and never

did - because income taxes are uniform indirect taxes, not non-apportioned direct

taxes, and they do not

constitute the lawful and legitimate, enforceable taxation that the Constitution allows, and every

defendant for the last 65 years was wrongfully and erroneously allowed by the courts to be charged,

tried, convicted, and sentenced for allegedly “failing” to pay a tax that doesn’t exist or file

a return that isn’t required, or for allegedly

“evading and defeating” a tax that again, doesn’t constitutionally

EXIST to be

lawfully enforced by any federal court, district or circuit.

23)

The

district and circuit courts of appeals lacked, and still lack,

the subject-matter jurisdiction of the court necessary to conduct criminal and

civil trials of American defendants, and now the courts have no other lawful

choice but to set aside the verdicts, vacate the judgments, and release the defendants being held all over America, because a court lacking subject-matter jurisdiction cannot conduct a trial of the

defendant, cannot render a verdict or allow a jury to do so, cannot enter

a judgment in a civil or criminal prosecution for which the court possesses

no valid, fully granted, and enforceable, subject-matter jurisdiction of the court that can lawfully be taken by the court over the specific

criminal charges made against a defendant, and cannot sentence any

defendant under such conviction rendered by a court without the required

subject-matter jurisdiction necessary

to legally act at all in any case.

"Once jurisdiction is challenged, the

court cannot proceed when it clearly appears that the court lacks jurisdiction,

the court has no authority to reach merits, but rather should dismiss the

action." Melo v. U.S., 505 F.2d 1026 (1974)

"Court must prove on the

record, all jurisdiction facts related to the jurisdiction

asserted." Latana v. Hopper, 102 F.2d 188; Chicago v. New York, 37 F.Supp. 150

"There is a presumption

against existence of federal jurisdiction; thus, party invoking federal

court's jurisdiction bears the burden of proof. 28 U.S.C.A. §§

1332, 1332(c); Fed. Rules Civ. Proc. Rule 12(h)(3), 28 U.S.C.A."

So

the Supreme Court ruling in June, 2024 in the attached Moore

et Ux v. United States

case, ruled in a manner

that make it possible for me to now IMMEDIATELY KILL ANY

IRS/DOJ legal action in the courts brought under Title 26 law, civil or

criminal, anywhere in the country.

This

SCOTUS case STOPS, BLOCKS, and FORECLOSES on ALL IRS claims for tax and ALL DOJ prosecutions in federal

court because the claims for tax are all being pursued unlawfully by the DOJ under an erroneous jurisdictional

claim – i.e. the claim that the 16th

Amendment authorize a non-apportioned direct

tax on income, - which is what the IRS is “assessing” in operational practice, as plainly and clearly stated and argued in their

published Frivolous Positions paper

(attached), which argument and claim (it’s a non-apportioned direct tax) the High Court just ruled is ACTUALLY the erroneous, FRIVOLOUS, position

and argument. That means there is no subject-matter jurisdiction that can be lawfully taken by any federal court to

enforce the claims for federal personal income tax created and lodged by the

IRS or DOJ.

The

Supreme Court just ruled in this case that income taxes are indirect taxes, NOT non-apportioned direct taxes (as wrongfully enforced for the last 65 years of

American history).

This

means that NO IRS assessment can be sustained in court (Tax Court too) anymore

because, according to the Supreme Court in this Moore decision, they are assessing a

tax that does not actually exist in law, or under the Constitution, because its

not direct, but only a part of the constitutional power to tax indirectly by Impost, Duty, and

or Excise,

- where income is the yardstick that measures the amount of tax owed, and is not the OBJECT

of the tax, nor even the SUBJECT of

the taxation. It is not a new

power to tax in any way, and it creates no new power to

tax, and impacts no new subjects of the federal taxing powers.

For $1,000 I can now defeat

the DOJ in federal court, on any tax claim brought to the court by the DOJ, for

any defendant, civil or criminal, anywhere in the country.

If you are in court with the

DOJ over income tax, or you know of anyone who is, regardless of whether or not

they already have an attorney, you (or they) need to contact me immediately

The

Moore

decision is a signed DEATH WARRANT

for the IRS and ALL DOJ prosecutions for income tax, BOTH civil and

criminal. It is a PERFECT CONDEMNATION of

the federal courts’ fraud and sedition committed across the last

65 years of our American history; - and history will condemn all of the

men and courts that have participated in, and are still participating in, the

perpetration of this monumental, national, judicial sedition and TAX

FRAUD, that has been perpetrated by the U.S. government on the American People,

and which is now destroying America and our entire society with the violence

and chaos of the class warfare that

has been created and unleashed upon us by the unconstitutional class

legislation that is the

federal personal income tax, IRC Section 1 – Tax imposed, allegedly imposing an unconstitutional direct and graduated income

tax instead of a uniform indirect tax as constitutionally required.

THIS IS MAJOR NATIONAL

NEWS AMERICA!

HELP ME

PUBLICIZE IT.

I NEED TO SPEAK

WITH PRES. TRUMP and ELON MUSK

– anyone who can

help facilitate that, is URGED to do so

Contact me here:

Tom@IRSzoom.com (703)

899-7369

And anyone in court over CIVIL

income tax claims (or alleged CRIMINAL income tax crimes), who needs legal

help, is urged to contact me to start the process in the federal court to KILL

the IRS/DOJ Complaint.

I am not an attorney, but I will kill the IRS for you, and

NO attorney will

even try!

Thomas

Freed

Cell: (703) 899-7369

Fax: (202) 280-1301

www.IRSzoom.com

& www.Tax-Freedom.com

Check out

the NEW Thomas-Freed Channel

on YouTube

Now available on SALE:

THE AMERICAN

TAX BIBLE

OR GET our “primer”

to start, for just $6 -

The Simple Truth

About Income Tax

www.TaxBible.com & www.AmericanTaxBible.com

Listen to Thomas Freed on the radio every

Thursday at 6 pm

On LibertyWorksRadioNetwork.com

WAKE UP AMERICA,

GET EDUCATED,

BE INFORMED!

END NOTE