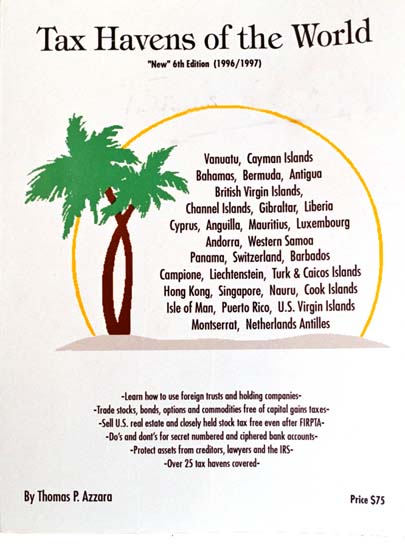

Over 20 tax havens

are covered in the book TAX HAVENS OF THE WORLD($75) including, the Bahamas,

Caymans, Switzerland, Vanuatu, Bermuda, Barbados, Hong Kong, Singapore,

Channel Islands & The Isle of Man (famous havens used by modern British

businessmen), Campione, Panama, Anguilla, Antigua, Liberia, Gibraltar,

Cyprus (shipping tax haven) and little Nauru (3rd smallest nation in the

world), and many more. Also covered are the Exempt Companies, the

International Business Corporation (IBC), the Foreign Trust, the Foreign

Personal Holding Company, Exempt Shipping Companies, Exempt Offshore Banks,

Exporting U.S. products tax free, the important U.S. Income Tax Treaties,

and Australian & Canadian tax havens. Of great importance to he American

planner is a complete disclosure on How to Avoid the U.S.A.'s "Controlled

Foreign Corporation" (CFC) legislation .

Over 20 tax havens

are covered in the book TAX HAVENS OF THE WORLD($75) including, the Bahamas,

Caymans, Switzerland, Vanuatu, Bermuda, Barbados, Hong Kong, Singapore,

Channel Islands & The Isle of Man (famous havens used by modern British

businessmen), Campione, Panama, Anguilla, Antigua, Liberia, Gibraltar,

Cyprus (shipping tax haven) and little Nauru (3rd smallest nation in the

world), and many more. Also covered are the Exempt Companies, the

International Business Corporation (IBC), the Foreign Trust, the Foreign

Personal Holding Company, Exempt Shipping Companies, Exempt Offshore Banks,

Exporting U.S. products tax free, the important U.S. Income Tax Treaties,

and Australian & Canadian tax havens. Of great importance to he American

planner is a complete disclosure on How to Avoid the U.S.A.'s "Controlled

Foreign Corporation" (CFC) legislation .

In Chapter 11(FOREIGN TRUSTS) you'll find out how Big "8" accounting firms exploit IRS Revenue-Ruling 69-70 to pass foreign source income onward to U.S. beneficiaries free from Federal Income Taxes" It's legal to do if you know how. Learn all about tens of thousands of foreign companies and trusts domiciled in no tax havens like the Bahamas and the Caymans - where American megabucks are hidden and secure.

From the

Author..... Foreign

banks and offshore companies avoid all U.S. capital gains on their stock

market trades! Really!! I live in the Bahamas. I know.! I work independently

of/with a Bahamian bank owned by a $20 billion dollar parent bank from South

Africa. I've formed over 800 International Business Companies since 1991.

Most of my companies end up with this bank for banking, investing and trading, tax free.

From the

Author..... Foreign

banks and offshore companies avoid all U.S. capital gains on their stock

market trades! Really!! I live in the Bahamas. I know.! I work independently

of/with a Bahamian bank owned by a $20 billion dollar parent bank from South

Africa. I've formed over 800 International Business Companies since 1991.

Most of my companies end up with this bank for banking, investing and trading, tax free.

Try a 12 month subscription to the newsletter the TAX HAVEN REPORTER

($150/12 issues) and receive FREE a copy of the 350 page NEW,

7th Edition of TAX HAVENS OF THE WORLD (normally $75).