«First

Name» «Last

Name»

«Address»

«City_», «State» «Zip»

«Date»

District Director

Internal Revenue Service

«IRS Address»

«IRS City_», «IRS State» «IRS Zip»

Re: Termination of Account

IRS Account Number: «SSN»

Tax Years: All Years

Dear «IRS Name Prefix» «IRS Last Name»:

I have learned the irrefutable Truth about the actual provisions of the income tax legislation that was enacted in 1913, and consequently am informing you of my intentions to rely upon the provisions of the statutes and Supreme Court decisions that are identified for you in this letter.

In 1916 the Supreme Court ruled that

the income tax legislation that was enacted is constitutional because the tax that was laid, was not laid as a direct tax under the

16th Amendment, as is so commonly mistakenly believed by so many

people in

"...by the previous ruling, it was settled that the provisions of the 16th Amendment conferred no new power of taxation but simply prohibited the previous complete and plenary power of income taxation possessed by Congress from the beginning from being taken out of the category of indirect taxation to which it inherently belonged.." Stanton v. Baltic Mining Co., 240 US 103, 112-113 (1916)

The Court further identifies that the income tax legislation actually enacted is clearly and obviously an indirect tax because it is laid in the form of a tariff.

“…, the appellant filed his bill to enjoin the corporation from complying with the income tax provisions of the tariff act of October 3, 1913.” Brushaber v. Union Pacific R.R. Co, 240 U.S. 1, 9 (1916)

Article 1, Section 8, Clause 1 of the Constitution of course authorizes Congress to lay indirect taxes. It states

"The Congress shall have power to lay and collect taxes, duties, imposts, and excises, … but all duties, imposts and excises shall be uniform throughout the United States"

A tariff, you should note, is one form of an impost, which is one of the three types of indirect taxes that are authorized by this provision of the constitution. However, one should also note that a tariff is a tax on foreign activity and foreign goods entering the country, as are all imposts.

The Supreme Court understood that in order to preserve the integrity of the Constitution itself, and prevent the 16th amendment from being used in away that would engineer an inherent conflict within it, and destroy its pre-existing provisions effectively prohibiting direct taxation of the American people, at Article 1, Section 2, Clause 3, which states:

"Representatives

and direct taxes shall be apportioned

among the several states which may be included in this union, according to

their respective numbers...";

and, at Article 1 Section 9, Clause 4, which states:

"No capitation or other direct tax shall be laid, unless in proportion to the Census or Enumeration herein before directed to be taken.";

it was necessary to establish by decision that the 16th Amendment did not authorize direct taxation without apportionment. The Court actually states in the Brushaber decision that the belief that the 16th Amendment authorizes a direct non-apportioned income tax is an erroneous assumption that is the cause of all the confusion;

“We are of opinion, however, that the confusion is not inherent, but rather arises from the conclusion that the 16th Amendment provides for a hitherto unknown power of taxation; that is, a power to levy an income tax which, although direct, should not be subject to the regulation of apportionment applicable to all other direct taxes. And the far-reaching effect of this erroneous assumption will be made clear…” Brushaber v. Union Pacific R.R., 240 U.S. 1, 11 (1916)

And, in further denying the proposition that the 16th Amendment authorizes a direct tax:

“…it clearly results that the proposition and the contentions under it, if acceded to, would cause one provision of the Constitution to destroy another; that is, they would result in bringing the provisions of the Amendment exempting a direct tax from apportionment into irreconcilable conflict with the general requirement that all direct taxes be apportioned. Brushaber v. Union Pac. R.R., 240 U.S. 1, 12

The Court further identifies the precise nature of the indirect scheme of taxation and indirect scheme relied upon by the enacting legislation of the tariff act to effect the collection of the income tax being laid:

“The act provides for collecting the tax at the source; that is, makes it the duty of corporations, etc., to retain and pay the sum of the tax …” Brushaber v. Union Pacific R.R. Co, 240 US 1, 21-22 (1916)

The entire true and actual scheme of the income tax, of “collecting the tax at the source”, under a legislatively created “duty” to behave as a tax collector and “retain and pay the sum of the tax” is clearly laid out by the Court in this one sentence. Today, we call this identified “duty” to “retain and pay the sum of the tax”, withholding. The legal duty to withhold (retain money), or collect tax from persons, before those persons ever receive payment, is clearly laid out in this one sentence.

The decision of the Court clearly states that the income tax (tariff) act creates and imposes a legal “duty” on the “... corporations, etc.,” to “retain and pay the sum of the tax”. This legislatively created “duty” of the “corporations, etc.”, identified by the Supreme Court in the Brushaber decision, is defined in the law and has been since the inception of this tax in 1913. Title 26 U.S.C. Section 7701(a) is also where the term “person” is defined, it states in pertinent parts;

§ 7701 Definitions.

(a) When used in this Title ...

(1). Person. – The term “person” shall be construed to mean and include an

individual, a trust, estate,

partnership, association, company or corporation.

…

(16). Withholding Agent. - The term "Withholding Agent" means any person required to deduct and withhold any tax under the provisions of sections 1441, 1442, 1443, or 1461.”

A person is not just an individual, but may be a company, “corporation, etc” precisely as identified by the Supreme Court in its decision.

Subsection (a)(16) of Section 7701, defining the Subtitle A income tax Withholding Agent, establishes the complete and entire authority to “retain and pay the sum of the tax”, or in other words, to withhold income tax from subject persons as directed by the language of the Subtitle A statutes of Title 26.

The “Withholding Agent” is tasked by the statutes with the duty to

withhold the income tax at the source, i.e.: from payments made, and then, acting as a tax collector, pay

over those withheld funds to the U.S. Treasury.

The legal definition of the term “Withholding Agent” is simple and straight-forward. To understand its complete enacted authority all one need do is read the actual code sections invoked by the statutory definition shown above in Section 7701(a)(16).

The code sections, 1441, 1442, 1443, and 1461, the only sections cited in the statutory definition of the Withholding Agent at 7701(a)(16), provide as follows;

§ 1441. Withholding of Tax on Nonresident Aliens

(a) General rule.

Except as otherwise provided

in subsection (c) all persons, in

whatever capacity acting having the

control, receipt, custody, disposal or payment of any of the items of income specified in

subsection (b) (to the extent that any of such items constitutes gross income from sources within the United States), of

any nonresident alien individual,

or of any foreign partnership shall deduct and withhold from such items a

tax equal to 30 percent thereof, except that in the case of any items of income specified

in the second sentence of subsection (b), the tax shall be equal to 14 percent

of such item. (emphasis added)

Section 1441 clearly only authorizes and requires the withholding of income tax from non-resident alien “persons”. Section 1442 provides that foreign corporate “persons” shall be treated similarly:

§ 1442 Withholding of Tax on Foreign Corporations

(a)

General

rule.

In the case of foreign corporations subject to taxation under this subtitle,

there shall be deducted and withheld at

the source in the same manner and on the same items of income as is provided in Section 1441 a tax equal to 30%

thereof. ....

It is

not necessary to examine the specific language of Section 1443, it simply provides for slightly modified treatment of

foreign tax exempt organizations. It is titled:

§ 1443 Foreign Tax Exempt

Organizations

These code sections, specifically invoked by actual reference in the statutory definition of the “Withholding Agent” only authorize the withholding of Subtitle A income tax from foreign “persons”. As identified by the Supreme Court in its controlling decisions settling the matter of the constitutionality of the income tax laws, this is how the income tax is legitimately collected and enforced, INDIRECTLY, by third party Withholding Agents acting as tax collectors for the U.S. Treasury, who shift the burden of the tax from themselves to the true subject taxpayers by withholding the income tax from the foreign “persons” who are the true subject taxpayers, and are actually made subject to the withholding of tax from their payments by the provisions of the statutes.

“Ordinarily, all taxes paid

primarily by persons who can shift the

burden upon someone else … are considered indirect taxes;”

Pollock v. Farmer’s Loan & Trust Co.,

157 U.S. 429, 558 (1895)

Title 26 U.S.C. Section 1461 is the last code section

referenced in the statutory definition of a Withholding

Agent as provided by 26 U.S.C. §

7701(a)(16). It explicitly states;

§

1461 Liability for withheld

tax.

Every person required to deduct and

withhold any tax under this chapter

is hereby made liable

for such tax and is hereby indemnified

against the claims and demands of any person for the amount of any payments

made in accordance with the provisions of this chapter.

This section clearly says that the Withholding Agents are made liable for the payment of the income taxes

that they have withheld from those subject foreign “persons”. It does not make the Withholding

Agent liable for the payment of tax on his own income. It does

not make citizens liable for the payment of tax on their own income, which would be an attempt to enforce an

unconstitutionally direct tax without apportionment and, as shown, that

argument was soundly rejected by the Supreme Court in 1916 in settling the

dispute in the Brushaber decision, and

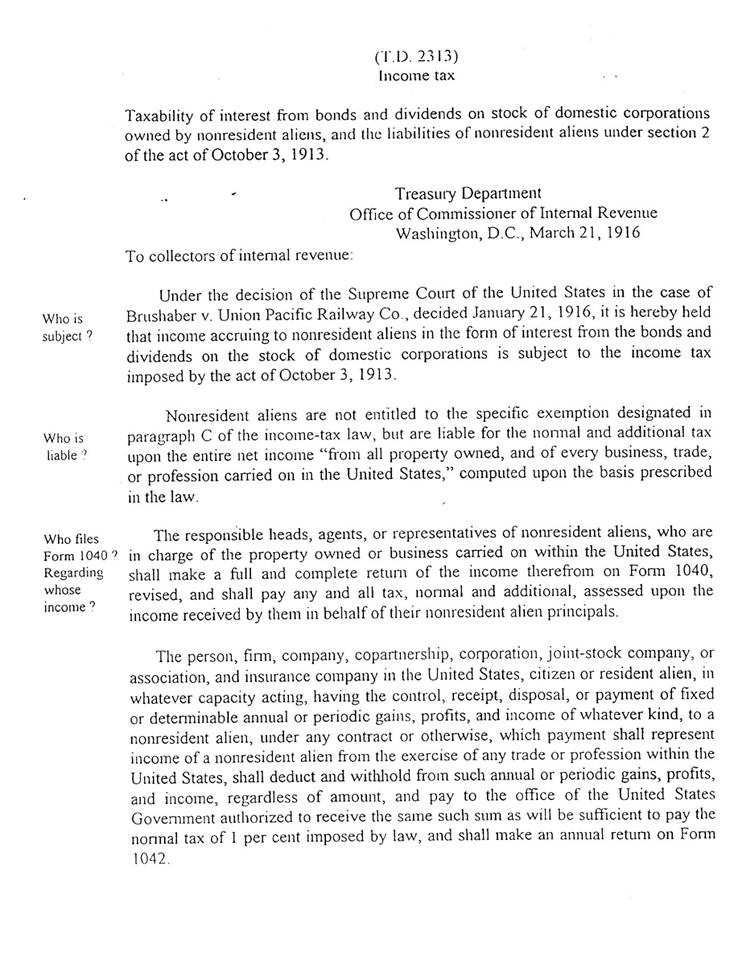

that is clearly reflected in Treasury Decision 2313 (Exhibit A) which resulted

from that case and was issued to enforce the decision of the Court.

Under the actual provisions of code sections 1441, 1442, and 1443, the only “persons” subject to the withholding of income tax are all foreign. Where is the statute in Subtitle A granting the authority to collect an income tax, by withholding from payments or in any other manner, from American citizens? Or even from resident aliens? Those statutes and provisions don’t exist because that authority is not granted because it would be unconstitutional, and because the income tax is a tariff laid on foreign activity in the United States, not the domestic activity of the American People. Under the Constitution the federal government is allowed to tax foreign activity in the United States, but still, even after the passage of the 16th Amendment, may not tax citizens, their property, their earnings, or the fruits of their labor in the form of income, directly.

“Thus, from every point of view we are brought irresistibly to the conclusion that neither under the Sixteenth Amendment nor otherwise has Congress power to tax without apportionment a true stock dividend made lawfully and in good faith, or the accumulated profits behind it, as income of the stockholder. Eisner v. Macomber, 252 U.S. 189, 219-220 (1920)

This decision, Eisner v. Macomber, was handed down 4 years after the Brushaber decision in 1916, and while it may seem at first to contradict the two previous Supreme Court rulings just referenced (Brushaber & Stanton), upon closer examination we find that the rulings are not contradictory at all, but are all consistent, capably differentiating in the various pieces of legislation being tested in the different cases, the difference between legitimate and constitutional indirect taxation by the laying of a tariff that is collected at the source by withholding from foreign persons, and the unconstitutionally direct taxation that would be constituted by the taking of a citizen’s dividend.

Eisner, quite simply, marks the Court’s ability to distinguish between the holdings in the previous cases of 1916 (Brushaber & Stanton), where the income tax legislation that was being tested was found to be constitutional (not because it was authorized as a direct tax by the 16th Amendment but because it enacted an indirect tax in the form of a tariff under a scheme of INDIRECT collection and enforcement), and the Pollock decision of 1896 which declared direct taxation of income without apportionment to be totally unconstitutional and unsustainable.

"... a tax upon property holders in respect of their estates, whether real or personal, or of the income yielded by such estates, and the payment of which cannot be avoided, are direct taxes..." Pollock v. Farmer’s Loan & Trust Co., 157 U.S. 429, 558 (1895)

and;

“… it is apparent (1) that the distinction between direct and indirect taxation was well understood by the framers of the constitution and those who adopted it; (2) that, under the state system of taxation, all taxes on real estate or personal property or the rents or income thereof were regarded as direct taxes;” Pollock v. Farmer’s Loan & Trust Co., 157 U.S. 429, 574 (1895)

and;

“The income tax law under consideration is marked by discriminating features which affect the whole law. It discriminates between those who receive an income of $4,000 and those who do not. It thus vitiates, in my judgment, by this arbitrary discrimination, the whole legislation. Pollock v. Farmer’s Loan & Trust Co., 157 U.S. 429, 596 (1895)

and;

“We are of opinion that the law in question, so far as it levies a tax on the rents or income of real estate, is in violation of the constitution, and is invalid.” Pollock v. Farmer’s Loan & Trust Co., 157 U.S. 429, 583 (1895)

and;

“I am of opinion that the whole law of 1894 should be declared void, and without any binding force,-that part which relates to the tax on the rents, profits, or income from real estate, that is, so much as constitutes part of the direct tax, because not imposed by the rule of apportionment according to the representation of the states, as prescribed by the constitution; and that part which imposes a tax upon the bonds and securities of the several states, and upon the bonds and securities of their municipal bodies, and upon on the salaries of judges of the courts of the United States, as being beyond the power of congress; and that part which lays duties, imposts, and excises, as void in not providing for the uniformity required by the constitution in such cases” Pollock v. Farmer’s Loan & Trust Co., 157 U.S. 429, 608 (1895)

and;

“The inherent and fundamental nature and character of a tax is that of a contribution to the support of the government, levied upon the principle of equal and uniform apportionment among the persons taxed, and any other exaction does not come within the legal definition of a 'tax.'” Pollock v. Farmer’s Loan & Trust Co., 157 U.S. 429, 599 (1895)

and;

“The legislation, in the discrimination it makes, is class legislation. Whenever a distinction is made in the burdens a law imposes or in the benefits it confers on any citizens by reason of their birth, or wealth, or religion, it is class legislation, and leads inevitably to oppression and abuses, and to general unrest and disturbance in society. It was hoped and believed that the great amendments to the constitution which followed the late Civil War had rendered such legislation impossible for all future time. But the objectionable legislation reappears in the act under consideration.” Pollock v. Farmer’s Loan & Trust Co., 157 U.S. 429, 596 (1895)

And, in recognition of the long since forgotten constitutional limitations on the federal power to tax,

“There is no such thing in the theory of our national government as unlimited power of taxation in congress. There are limitations, as he justly observes, of its powers arising out of the essential nature of all free governments; there are reservations of individual rights, without which society could not exist, and which are respected by every government. The right of taxation is subject to these limitations. Citizens' Savings Loan Ass'n v. Topeka, 20 Wall. 655, and Parkersburg v. Brown, 106 U.S. 487, 1 Sup. Ct. 442.” Pollock v. Farmer’s Loan & Trust Co., 157 U.S. 429, 599 (1895)

and;

“Although there have been from time to time intimations that there might be some tax which was not a direct tax nor included under the words 'duties, imposts, and excises,' such a tax for more than one hundred years of national existence has as yet remained undiscovered, notwithstanding the stress of particular circumstances has invited thorough investigation into sources of revenue.” Pollock v. Farmer’s Loan & Trust Co., 157 U.S. 429, 557 (1895)

And finally,

“Here I close my opinion. I could not say less in view of questions of such gravity that go down to the very foundation of the government. If the provisions of the constitution can be set aside by an act of congress, where is the course of usurpation to end? The present assault upon capital is but the beginning. It will be but the stepping-stone to others, larger and more sweeping, till our political contests will become a war of the poor against the rich,-a war constantly growing in intensity and bitterness. 'If the court sanctions the power of discriminating taxation, and nullifies the uniformity mandate of the constitution,' as said by one who has been all his life a student of our institutions, 'it will mark the hour when the sure decadence of our present government will commence.' If the purely arbitrary limitation of four thousand dollars in the present law can be sustained, none having less than that amount of income being assessed or taxed for the support of the government, the limitation of future congresses may be fixed at a much larger sum, at five or ten or twenty thousand dollars, parties possessing an income of that amount alone being bound to bear the burdens of government; or the limitation may be designated at such an amount as a board of 'walking delegates' may deem necessary. There is no safety in allowing the limitation to be adjusted except in strict compliance with the mandates of the constitution, which require its taxation, if imposed by direct taxes, to be apportioned among the states according to their representation, and, if imposed by indirect taxes, to be uniform in operation and, so far as practicable, in proportion to their property, equal upon all citizens. Unless the rule of the constitution governs, a majority may fix the limitation at such rate as will not include any of their own number.” Pollock v. Farmer’s Loan & Trust Co., 157 U.S. 429, 607 (1895)

All parties should please note that, according to the Supreme Court, all of these arguments identified by Justices Fuller and Fields in 1896 remain unaffected by the adoption of the 16th Amendment in 1913. Remember, the Court said in the Stanton decision that the 16th Amendment “conferred no new power of taxation”, and that the income tax that is laid in statute by the act tested “is inherently indirect”.

The Pollock decision has never been overturned by the Supreme Court, and is not overruled by the adoption of the 16th Amendment. Pollock and Eisner upheld the constitutional prohibition on direct taxation without apportionment (even after the 16th Amendment), while Brushaber and Stanton upheld the federal power to tax indirectly (in the form of a tariff). The cases address different issues and aspects of the Constitution entirely, one addressing the power to tax directly, the other addressing the power to tax indirectly. They do not contradict or conflict with one another, but rather work hand in hand to uphold the clear distinction between the two great classes of taxing powers established in the Constitution for the federal government to exercise.

In 1920, in the Eisner decision, after the 16th Amendment, the Court resurrects and upholds again the Pollock decision of 1896, and REJECTS AGAIN the Congressional attempt to allow the government to tax income directly without apportionment.

“The Revenue Act of 1916, in so far as it imposes a tax upon the stockholder because of such dividend, contravenes the provisions of article 1, 2, cl. 3, and article 1, 9, cl. 4, of the Constitution, and to this extent is invalid, notwithstanding the Sixteenth Amendment.” Eisner v. Macomber, 252 U.S. 189, 219-220 (1920)

Seven years after the adoption of the 16th Amendment, the Supreme Court again says (based on the Pollock decision in 1896), that it is still unconstitutional to tax income directly, despite the 16th Amendment’s existence and adoption.

As regards this simple reading of the establishment of statutory liability;

“In all cases involving statutory construction, a court's starting point must be the language employed by Congress, and it would be assumed that the legislative purpose is expressed by the ordinary meaning of the words used; thus, absent a clearly expressed legislative intention to the contrary, that language must ordinarily be regarded as conclusive.” American Tobacco Co. v. Patterson, 456 US 63

The “persons” made subject to the withholding of income tax from their payments are all foreign of course because these legislative provisions are the “income tax provisions of the tariff act of Oct. 3, 1913” that the Chief Justice White refers to in the first sentence of the Brushaber decision upholding the constitutionality of the tariff legislation that was tested in that case. A tariff is an impost, which is a foreign tax, and only persons involved in foreign activity are subject to the payment of it. The power to lay tariffs on foreign imports and activity is a “complete and plenary” indirect power to tax that has been possessed by Congress from the beginning under Article 1, Section 8, Clause 1 of the Constitution, again, precisely as identified by the Supreme Court in the Stanton decision.

There is no other code section anywhere in Subtitle A, besides Section 1461, making any other person or party liable for the payment of any Subtitle A income tax. In fact, the only other code section in all of Title 26 that specifies that any other person or party is liable for the payment of the income tax is Title 26 U.S.C. § 3403, from Subtitle C of Title 26, which states;

§ 3403. Liability for tax

The employer shall be liable for the payment of the tax required to be deducted and withheld under this chapter, and shall not be liable to any person for the amount of any such payment.

Again, we find that the statutes are consistent. In the Subtitle C provisions adopted in 1944, just like in the Subtitle A provisions adopted in 1913 and tested 1916, we find again that it is the tax collector who is made liable in the statutes for the payment of the income tax. In Subtitle A, the Withholding Agent is made liable for the payment of the income tax that he has withheld from foreign “persons”, and in Subtitle C it is the “employer”, another “person” acting in the capacity of a tax collector, that is made liable for the payment of the income tax that he has also withheld from others, his participating employees in this case.

Sections 1461 and 3403 are the only statutes in all of Title 26 that

make any persons liable for payment of the income tax. By making only the tax collectors,

acting in the capacity of a either a “Withholding

Agent” or an “employer”, liable by statute for the

payment of the (withheld) income taxes, the statutory scheme for the collection

and enforcement of the income tax as enacted in 1913 is kept entirely indirect,

and therefore, as found by the Supreme Court, is constitutional as an indirect tax laid on foreign activity in the

United States.

It

is not constitutional because the Constitution now allows direct

non-apportioned taxation of the people under the 16th Amendment, as

the government seems to believe, but because the statutes only actually implement a very indirect

tax that is collected and paid by third-party tax collectors (Withholding Agents) who shift the burden

of the tax they pay by withholding the tax from other, third-party persons who are made subject by law to the withholding of the tax, and who, under

the law, are all foreign “persons” properly subjected to the

provisions of a tariff.

The Title 26 statutes do not make the sovereign American people themselves the direct subject taxpayers of the income tax. The legislation actually enacted correctly recognizes the true and proper role of the Sovereign in any system of taxation, and makes them the tax collectors, as sovereign citizens are the “etc.” referenced in the “duty of the corporations, etc.” quote referred to in the Brushaber decision cited above. I repeat, it is absolutely clear that the true legal role of the American people is the role of the tax collector, acting as a “Withholding Agent”, and that We the People are not actually made the subject of the income tax, nor are we assigned the role of the taxpayer. That role is reserved for the foreign subjects of the federal government.

By injecting this third party, the Withholding Agent, into the scheme for “collecting the tax at the source”, the burden to pay the income tax is shifted by withholding from the payer of the tax - the tax collector, the Withholding Agent, to the actual taxed subject and real taxpayers - the non-resident aliens and foreign corporations that are the proper taxed subjects of the federal government under the Subtitle A provisions of the tariff act, and, under the Constitution.

“Ordinarily, all taxes paid primarily by persons who can shift the burden upon someone else, or who are under no legal compulsion to pay them, are considered indirect taxes;” Pollock v. Farmer’s Loan & Trust Co., 157 U.S. 429, 558 (1895)

The injection of this third party, the Withholding Agent, into the Subtitle A income tax collection scheme of “collecting the tax at the source”, keeps the income tax indirect because the tax is collected by a third party – the Withholding Agent, and the burden is shifted from that third party tax collector to the subject foreign taxpayer through withholding.

Under the actual provisions of the statutes, the tax is not collected directly by the government from the subject taxpayer as you are improperly attempting to do in the instant matter, but is collected indirectly by the third party Withholding Agents. Under the actual provisions of the statutes, the sovereign American citizens and corporations are not taxed directly and are not cast in the role of subject taxpayers, but rather are empowered as tax collectors. It is the subject foreign non-resident persons, individuals and corporations, that are actually cast in the role of the subject taxpayers by the language of the statutes implementing the “income tax provisions of the tariff act of Oct. 3, 1913”.

Additionally, Section 1463 clearly states who is to be penalized if the tax is not properly withheld and paid into the U.S. Treasury as proscribed by these statutes;

§ 1463. Tax paid by recipient of income

If—

(1) any person, in

violation of the provisions of this chapter,

fails to deduct and withhold any tax under

this chapter, and

(2) thereafter

the tax against

which such tax may be credited is paid,

the tax so required to be deducted

and withheld shall not be collected from such person; but this section shall in no case relieve such person from liability for interest or any

penalties or additions to the tax otherwise applicable in respect of such failure to deduct and withhold.

This code section says that it is the Withholding Agents who are responsible for and must pay the penalties, interest, and additions to tax that are due on the income tax that was not properly withheld, reported, and paid into the Treasury. It is not the actual foreign taxpayer who is penalized by any of these penalties or additions by this statute, it is the tax collector, or Withholding Agent, who is penalized. Again, this keeps the tax and its enforcement under the statutes, indirect. If the actual taxpayers were made subject to interest, penalties and additions to tax that would be unconstitutionally direct taxation without apportionment and would also be a violation of the Constitution.

The analogy one can very quickly and easily make is that of a sales tax collected by the stores in the fifty states. The sales tax is an indirect tax that is not imposed on any person, per se, but on certain transactions. When it is imposed on a transaction it is collected by a third party, the tax collector, the store. It is not collected by the government itself from the taxpayer. The government deals only with the tax collector, not the taxpayer.

And, it is the store, the tax collector, that is made liable for the payment of the tax to the Treasury, not the customers, the actual taxpayers. Finally, if the tax collector (the store) fails the duty to collect the sales tax as required, it is again the tax collector (that store), and not the taxpayer, that is punished for that failure and made liable for penalties, fines, and additions to tax thereby incurred. The collection of the federal income tax is obviously properly effected under the true provisions of the Subtitle A statutes in exactly the same indirect manner with the “Withholding Agent” being cast in the role of the “store”, as the tax collector.

It

is clear that under the true provisions of the statutes of Subtitle A, the

income tax is a tax that is collected indirectly at the source by

withholding. Under the provision of the

statutes, it is the tax collector in

the form of the Withholding Agent who

is made liable for the payment of the tax.

Having withheld the money as tax from payments made to other persons,

the tax collector is made liable by

statute for the payment of the tax so that he is legally obligated to make

payment of the withheld collected funds over to the U.S. Treasury. Again, in the provisions of the statues under

§ 1463, it is the tax collector who is punished for a

failure to pay, not the taxpayer,

and these facts again work to keep the

whole scheme of the income tax legislation, together with all of the

provisions for the collection and enforcement of the income tax, indirect and constitutional;

The primary and general rule of statutory construction is that

the intent of the lawmaker is to be found in

the language that he has used. He is presumed to know the meaning of the words and the rules of grammar. U.S. v Goldenberg, et a!., 16S U.S.

95, 102 (l897).

As regards myself: I am a citizen of the state of «State» and of the United States of America. I am not a non-resident alien or foreign corporation who is subject to the withholding of income tax, or who is subject to the payment of the indirect income tax enacted under the provisions of the “tariff act of Oct. 3, 1913”. Further, I am neither a “Withholding Agent” nor an “employer” who has withheld any income tax from any subject “persons”, and because I am neither an “employer”, “Withholding Agent” or alien “person”, I am not made liable for income tax by any statute. I have earned no money in the territories or possessions where the federal government may tax outside the limits of the Constitution, or in any foreign country under a tax treaty that would make my foreign earnings taxable to the federal government outside of its territorial jurisdictions, and I conduct no activity involving the sale or commercial transportation of alcohol, tobacco, or firearms products or materials.

Based on the information provided to you above by this letter, I believe that you now have a legal duty to please close this account permanently.

Thank you for your prompt attention to this matter and legal duty.

Sincerely,

___________________________

«First

Name» «Last

Name»

Exhibit A