The Employer & The Income Tax

In 1944 the

In 1944, new laws were added that expanded

the authority to withhold income tax, which up until this time had been an

authority defined strictly in terms of withholding from “foreign” non-resident

entities. But in 1944, the authority to

withhold income tax was expanded to include an “employer” making payment of “wages”

to an “employee” under Section 3402(a).

It is important to understand that the

existing definition and powers of the Withholding

Agent to withhold income tax did not change, they remained the same as they

were previous to 1944. However, another

entity, the “employer”, is authorized for the first time in 1944 to also begin

withholding income tax. So the Withholding Agent withholds tax under

Subtitle A (which was enacted in 1913), and the employer withholds income tax

under Subtitle C (which was enacted in 1944).

This expansion of the definition of the

authority to withhold income tax, to apparently empower the employer to

withhold the tax from wages paid to employees, has made it very easy for the

United States government to deceive the American people since 1944 into

believing that they are the subject of the income tax through their

relationship with their employer.

However, the actual language of the whole statute that authorizes the

withholding makes it very clear that is not true because there are exceptions in

the law that the employer must recognize and honor. It is important to understand that the income

tax law itself was NOT changed to expand the actual application of the income

tax to include employees, i.e.: no income tax is IMPOSED in Subtitle C on employees,

it is just authorized to be withheld from them by the employer.

However, the government has built a system

of de-facto operations that is taking advantage of the average citizen’s

ignorance of the extremely technical interactions invoked by the specific

language of the code sections, and has established a system wherein the citizen

is absolutely required to have a nearly perfect knowledge of the law in order

to understand that these income tax withholding provisions of Subtitle C in

Section 3402(a), do not apply to him or her.

So, it is important to understand that

while the authority to withhold income taxes appears to have been expanded in

Subtitle C by Section 3402(a), which we will examine in a moment, in reality it

has not, because while the Subtitle C statute appears to authorize the

withholding of income tax from “wages”, it does not actually expand the group

of persons whom the income tax was (and is) actually imposed upon under the

law, – AND THE STATUTE ITSELF MAKES

PROVISION FOR THAT REALITY.

The authority of the “employer” to withhold

income tax from the “wages” of the “employee” under the Subtitle C authorities,

as you will see, is hinged upon the employee’s ignorance of the actual

provisions of the Subtitle A income tax laws.

The authority of the “employer” to withhold

income tax from the “wages” of the “employee” is established in Title 26 U.S.C.

Section 3402(a). It states:

§ 3402. Income tax collected at source

(a) Requirement of withholding

(1) In general

Except as otherwise provided in this section, every employer

making payment of wages shall deduct and

withhold upon such wages a tax determined in accordance with tables or

computational procedures prescribed by the Secretary ...

Note that the very first sentence of this

statutory authority to withhold income tax from wages is prefaced by the clause

"Except as otherwise provided in this section". Does that sound relevant?

The

complete and actual authority to withhold income tax from wages under this

statute (3402) is not entirely stated in subsection (a), which is where most

people stop reading the law. The true

authority is clearly identified by the specific language of subsection (n) of this same section (3402).

Subsection (n) of Section 3402, states:

(n)

Employees incurring no income tax liability

Notwithstanding

any other provision of this section, an employer shall not be required to

deduct and withhold ANY tax under this chapter upon a payment of wages to an employee if there is in effect with

respect to such payment a withholding

exemption certificate (in such form and containing such other information

as the Secretary may prescribe) furnished to the employer by the employee certifying that the employee -

(1) incurred no liability for income tax

imposed

under subtitle A for

his preceding taxable year, and

(2) anticipates that he will incur no liability for income tax imposed

under subtitle A for his current taxable year.

The Secretary shall by regulations provide for the

coordination of the provisions of this subsection with the provisions of subsection

(f). ... (emphasis added)

Please,

carefully note that subsection (n) clearly states that no income tax is withheld from the employee if that employee certifies that he or she has no liability

for income tax under Subtitle A.

This, of course, is in recognition of the fact that the income tax of

Subtitle A is not actually imposed on all persons, but rather, is only imposed

on, and withheld from, non-resident aliens and foreign corporations. The purpose of this code subsection, (n), is

to make lawful provision for those persons upon whom the income tax is not imposed in Subtitle A, to avoid in Subtitle C the withholding of

tax that they are not required to pay.

Now, as we all have seen and now know, the only liability for income tax that is

established in the law in Subtitle A is the liability under Section 1461 of the Withholding

Agent for the tax that he has withheld from those subject foreign

persons. Additionally, we have

identified that Treasury Decision 2313 also stated

that non-resident aliens were liable for

payment of the income tax on all of their trade and business as well.

So, if you are not a non-resident alien,

but an American citizen, and you do not act in the capacity of a Withholding Agent in dealing with foreign

persons that you withhold tax from (which most citizens do not), then - if you certify to your employer that you have no

liability for income tax under Subtitle A, which you can honestly do (and prove

with this book), then this statute says that your employer does not have to

withhold ANY (income) tax from your wage payments.

Now, could that be any simpler? But you do see that the withholding of income

tax from an employee’s wages by the employer is dependent upon the employee’s

ignorance of the statutory liability specifications for income tax established

in the law in Subtitle A?

One should also note that Subsection (f),

whose provisions the Secretary is commanded to coordinate with the provisions

of this subsection (n), is entitled:

"(f) Withholding exemptions".

To be clear and complete we should all note

that the employee also does not have any

liability for income tax under the statutory provisions of Subtitle C. Section

3403 is the only statute that specifies liability for payment of the income tax

in Subtitle C, just like Section 1461 was the only statute that specified

liability for the payment of the income tax in Subtitle A. Section 3403 states:

The employer shall be liable for the payment of the tax required to be deducted

and withheld under this chapter, and shall not be liable to any person for the

amount of any such payment.

Wow!

Unbelievable! Again, in the law we find that the tax is (still) an INDIRECT tax, collected indirectly, by withholding from subject persons (who must now know whether or

not they are subject, whereas before, it was just taken from the taxpayer

because they were foreign and not resident).

And the only liability that exists in the

law in Subtitle C for the payment of the income tax is, again, the liability of

the person who has collected the tax by

withholding (the employer), just

like in Subtitle A (the Withholding Agent), keeping the tax and its collection indirect by, again making provisions

to shift the burden from the employer to the subject employee, just as the

burden was shifted in Subtitle A from the Withholding

Agent to the foreign subject taxpayer.

In Subtitle C it is the employer,

and not the employee, who is legally liable for the payment of the income tax

that has been withheld from employees under the provisions of Subtitle C’s

Section 3402. But the employer is of

course only liable for tax where money is actually withheld from

wage payments. If no money is actually

withheld by the employer, then there can be no liability actually incurred in

the name of the employer.

If an employer does not deduct and withhold

from wage payments to an American citizen because that citizen has certified

that they have no liability for income tax under Subtitle A in the preceding

year and anticipates that they will have no liability for income tax under

Subtitle A in the current year (as specified in subsection (n) of Section

3402), then the employer does not have

to withhold any income tax from the employee’s wage payments, and the

employer is not liable for the

payment of any tax on those exempt payments, and the employer cannot be made liable for any tax,

interest, or penalties associated with the failure to deduct tax under

Section 3402(a) from those wage payments, because in the clear language of

subsection (n) he has a statutory exemption requirement that he must honor.

Now one might object that it is wrong to

take (by withholding) pay from someone, allegedly for tax, when that person is

not actually subject to the tax, but the government has this angle taken care

of too. While the government tells the

citizens that it is Section 3402(a) under which the withholding of income tax

from citizens is required and takes place, it is actually Section 3402(p),

because as we have shown, there is no requirement under subsection (a) that

would apply to a citizen (who certifies that he is not liable under Subtitle

A). Without an establishment of

liability for income tax under Subtitle A, there should be no withholding of

income tax from anyone under Subtitle C, unless of course, there is an

agreement between parties allowing for such withholding. Subsection (p) of this same code section,

3402, makes just such a provision:

(p) Voluntary

withholding agreements

(3) Authority for other voluntary withholding

The Secretary is authorized by regulations

to provide for withholding—

(A) from remuneration for services performed by an employee for the employee’s

employer which (without regard to this paragraph) does not constitute wages,

and

(B) from any other type of payment with respect to which the Secretary finds

that withholding would be appropriate under the provisions of this chapter,

if the employer and employee, or the person making and the person

receiving such other type of payment, agree

to such withholding. Such agreement

shall be in such form and manner as the Secretary may by regulations prescribe.

…

Do

you know what form the agreement takes?

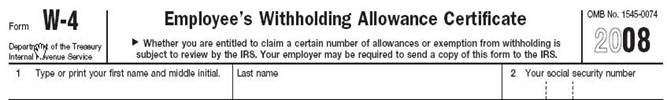

You should, you signed it. It’s

often called a W-4, but the actual name of the form is printed in big black

letters right on the top of it. We all

just ignore what it says without thinking because we have been told we have to

do this (which is not true for American citizens).

The

complete name of the agreement (form W-4) is Employee’s Withholding Allowance

Certificate.

You do know what “Allow”

means, right?

So, if you want to lawfully

terminate the withholding of income tax from your wages by your employer,